The roles of physicians and health insurers

Part four of our series Healthcare from First Principles

If the patient is the ultimate beneficiary of healthcare, then a healthcare system should exist, first and foremost, to address the patient’s needs. Right?

Medical workers, hospitals, health insurers, and pharmaceutical companies make up most of healthcare systems. But how does one map from patient’s needs to healthcare institutions?

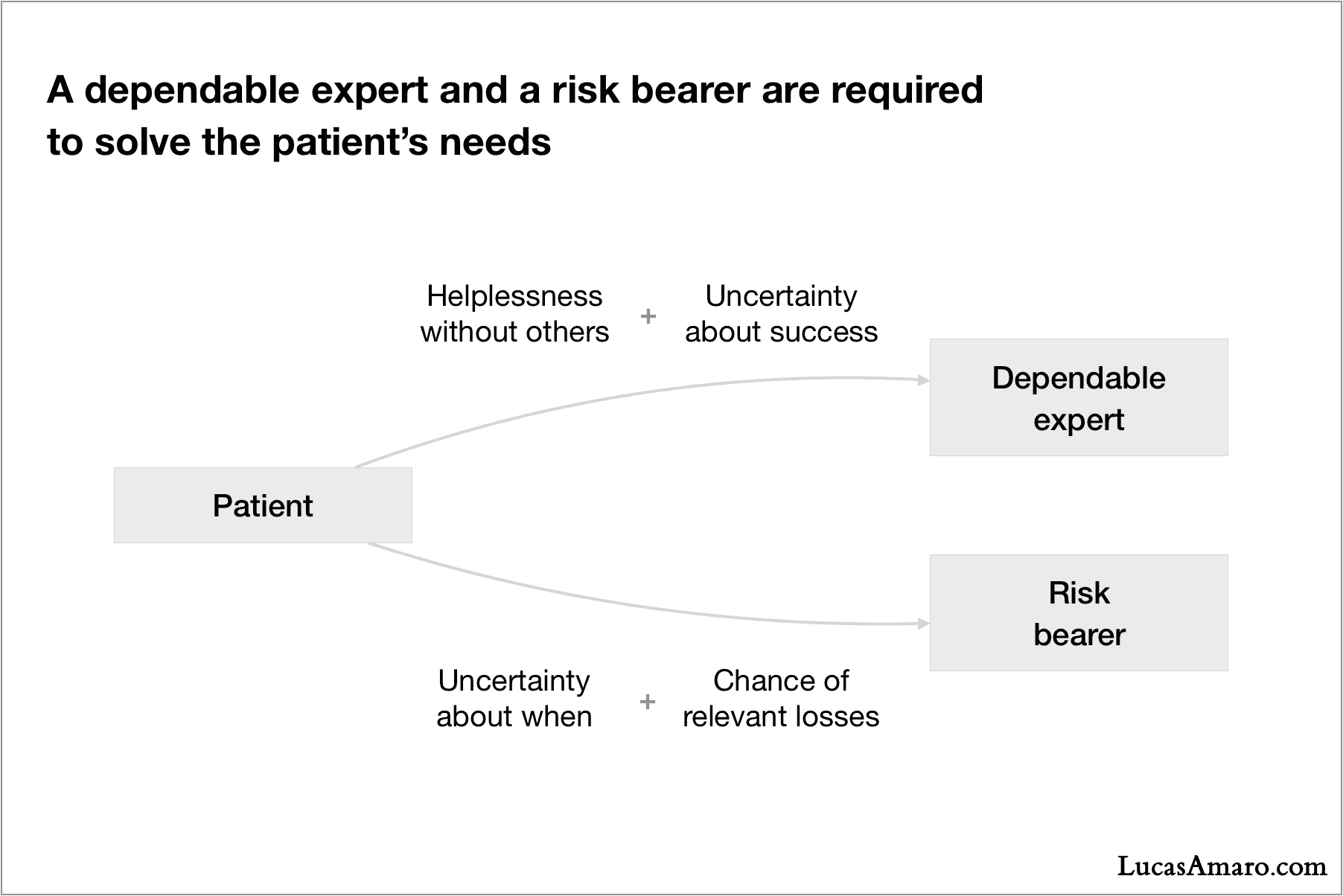

I believe that the elements that shape the patient’s needs are a useful guide for understanding why healthcare is the way it is. I have put forward there that these elements are helplessness without others, uncertainty as to when, uncertainty about success, and chance of relevant losses.

In healthcare systems, these four elements are addressed by two actors, each actor tackling a pair of elements:

Dependable expert? Risk bearer?

I have taken the liberty to create new terms to describe two very familiar actors in healthcare. My intention is to trigger a new perspective for a subject that is so commonly overlooked.

The dependable expert helps the patient overcome immediate discomfort and/or reduce the chances of future discomfort. It’s a role held by physicians and related professionals. The dependable expert helps the patient in their time of trouble, and thus addresses the helplessness without others. They are the others that come to help.

Since the dependable experts are the ones performing the actual care, they are also deeply connected to the uncertainty about success. In fact, this is one of the good reasons for the patient to seek experts.

A risk bearer is someone who takes on the risk for someone else. In the case of healthcare, the risk bearer is either a private health insurance company — as for most Americans — or a government-related institution — as in Medicare, Medicaid, and Veterans Affairs. The risk bearer plays the role of an insurer, and thus is responsible for helping the patient cope with the chance of relevant losses and the uncertainty as to when incidents could happen.

Insurance, in a nutshell, consists of (A) an insured trading the chance of a substantial financial loss to (B) the certainty of a more affordable payment that covers against the event of such loss. For example, in healthcare, one might pay a monthly bill to a health insurer — the “affordable payment” — in order to be covered against the event of a hospitalization, surgery, etc — the “loss event”.

To make this seemingly magical exchange economically viable, the insurer first aggregates payments from many diverse insureds. Then, because the substantial losses are expected to not happen at the same time, the insurer is able to reimburse the ones that happen and still profit with the remainder — i.e., the insured events that did not happen.

The risk bearer, by providing insurance, helps to make the financial side of the patient’s risk more manageable. That is why, in many ways, the risk bearer lightens the burden of uncertainty for the patient.

As with everything in real life, there are trade-offs and profound dilemmas to this multi-actor arrangement. I will explore them in a future essay.

To be continued.

December 2018

Healthcare from First Principles

Series about the fundamental reasons why healthcare systems are so convoluted, and why that is unlikely to change in the near future:

- Healthcare is about discomfort

- The two most fundamental facts in Healthcare

- The difficulties patients face

- The roles of physicians and health insurers · Here